Welcome back to “Explainers” at Moldova Matters! This Explainer is Part 1 of 2 in a series exploring how business organization affects the economy. In Part 1 we will look at the Moldova Stock Exchange and Joint Stock Companies. In Part 2 we will discuss Limited Liability Companies (SRLs) and how they spur offshoring in Moldova.

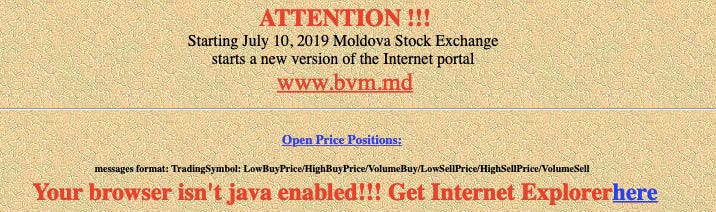

In this explainer, I spoke to a friend with deep experience in Moldova’s financial markets to try and answer the question, why in the world does the website for the Moldova stock exchange look like this?

Very helpfully, you are instructed to install Internet Explorer 4 before you follow the manual redirect link to their new website which is here. The new site is a bit more modern, but is still largely incomplete with entire pagesthat arejust blank. It does provide the daily trading information and you can see that there is usually around one trade per day.

I wondered, what is the history of these markets in Moldova? And what happened to bring the market to the place it is today? Here is a summary of our conversation and a look into the wild world of Moldovan markets.

What is the History of Moldova’s Stock Market?

To answer this question we have to start with where it came from. At the time of independence, Moldova was operating on the Soviet model of state controlled industries. In order to transition from this system to “capitalism” Moldova followed the lead of Russia and others, and instituted a policy of “shock privatization.” Every citizen was given vouchers that they could exchange for shares in some of the new privatized companies. The idea was that the number of vouchers you got would be based on your age and work history. Basically, the vouchers would let you buy into the national economy based on your vested stake in it. But these vouchers themselves were tradeable which led to workers and farmers, who had no experience with stock trading, to sell them off at ridiculously low prices to anyone who had money. In the chaos and economic uncertainty of the early 90s cash was king and people simply wanted money to live. So those with money were able to amass lots of control of these enterprises. In much of the former USSR this created the system of oligarchs that rule to this day. In Moldova, this happened to a more limited extent as the country had very limited industry to begin with. In particular, while collective farms went through this process in most countries, in Moldova they were instead divvied up in small land parcels to citizens. This plagues the process of creating a modern farming industry to this day as most land is in very small strips. But it also prevented oligarchic monopolization of Moldova’s one major resource, the land.

So following this process the Moldova Stock Exchange was opened in 1994 and new companies were created and listed in addition to the privatized state enterprises. These companies are referred to as SAs which is an acronym basically referring to a “Joint Stock Company.” In those days many new companies were formed as SAs since there was little regulation and people followed a romantic idea of owning a traded company.

For a while trading really did happen to some degree. Investment companies operated on the market and the major banks were traded on the market. There was even an IPO for Euro Credit Bank in 2004. Moldova’s first and last real IPO.

The Death Knell of the Market

In 2008 and 2009 the world entered the economic crisis known as the Great Recession. This crisis, spurred by the overleveraged mortgage market in the United States had global impact including destabilizing effects on Moldovan banks. It was at this point that some of the investment companies operating on the market, that had carried out scams and schemes for years, pivoted even more towards outright raider companies. These raids attacked the banks and confidence in the market was mortally damaged.

Is a “raid” like a “hostile takeover?”

Nope. In a traditional “hostile takeover” a group of shareholders attempt to take over company management by leveraging their ownership and shareholder rights to acquire board seats and replace the management team. In these raider attacks, shares were outright stolen from their owners. There were lots of mechanisms for this but one of them stemmed from the market structure itself. The Moldova Stock Exchange registered offers and trades but did not keep track of company ownership. Specialised companies operated as “registrars” and for a fee would keep the stock certificates and shareholder records for SAs. Certain oligarchs began raiding companies by buying the registrars and gaining access to the stock certificates. They would simply change the shareholder records without the owners having any idea. This period of raiding, especially with banks, led right up to the Theft of the Billion and is at the root of many of Moldova’s political and economic issues right to this day.

Ok, so that’s the History of the Market, how Does it Work Today?

Basically, it doesn’t really. The Stock Exchange is still technically functional but as you can see from the website it’s not really active. The main purpose these days is for additional privatizations of government owned industries whereby shares will be listed on the market by the relevant government authorities to raise money off some state owned enterprise.

Registrars and dedicated broker companies have largely disappeared. Banks act as brokers and the government learned from the mistakes with the registrars and now the Stock Exchange keeps a central record of shareholders. Though, it is worth noting, that the office and building these records are kept in was seized last month in an alleged raider attack which was later fought off by the Prosecutor General. This is not to say the attack had anything to do with the Stock Exchange, only to highlight that the system remains vulnerable to moneyed oligarchs behaving badly.

Right now, the old SA’s are essentially relics of an earlier age. New companies, including some of the largest in Moldova, are SRLs or “limited liability companies.” These SRLs suffer from extremely inflexible shareholder structures when compared to limited liability companies in other countries. This means that new companies needing flexible shareholder structures, but not willing to deal with the non-functional market, chose to form offshore. This is something we’ll talk about in Part 2 of this Explainer series where we deal with SRLs and offshoring in more depth.

Can the Market be Reformed?

Possibly, but the chances don’t look great right now. Before reading this article most of you didn’t realize there was a Stock Market in Moldova. And the people who run it might actually like it that way. Many of the same people who opened the market in 1994 are still running it and they are comfortable. Which definitely makes sense given the website. There is no institutional bandwidth for solving these problems. And there is no market demand for it with offshoring and private markets filling these financial roles for most businesses.

One potential future for public companies in Moldova is the idea of a regional market. Some large Moldovan brands like Purcari Winery have recently gone public on the Romanian Stock Exchange. It’s possible that the Bucharest based Stock Exchange is going to be more important for Moldovan companies, or even that a regional exchange could be created. But taken alone Moldova may be too small, and too unpredictable, for a functioning market of its own.

That said, part of the reason that lack of a market hasn’t been a big problem for business in Moldova, is that Continental European companies generally don’t trade in the way we are used to seeing on the New York, London or Tokyo Exchanges. European companies run more on a bond market preferring to sell and trade these financial instruments without giving up significant control of the companies. In theory, the Moldova Stock Exchange could support a healthy local bond market. The laws are in place and the paperwork isn’t much harder than you would require for a bank loan. But the last bond issue was in 2004 so a new company wanting to make a listing might have to shake the dust off of the forms needed.

The Case for a Bond Market

The following is the opinion / analysis of the author.

In my time in Moldova, I have worked with and spoken to many international and local investors who have started or invested in small companies here. Equity investment in an SRL is hard. Offshoring has its own issues. And SAs are not an option as we discussed above. Many prefer loans structured as private bonds as a safer and less complicated way of investing. It seems to me that there is a real case for a well regulated, but easy to access, local bond market for Moldvoan companies to access capital. This would be especially useful for companies that have high NPS (Net Promoter Scores), or basically, high customer affection and brand loyalty. Right now, access to finance is a major issue for small and medium companies, as there is also no real mechanism for raising money outside of the banks or microfinance institutions.

To me, a bond market designed for the needs of the small and medium companies in Moldova seems like a good direction for the Moldovan Stock Market to go in.

What do you think? Leave a comment or share your thoughts with me by email!

Fantastic explanation about Moldova itself, plus it also gives me clues to other questions I've always had, like what in the world happened to Russia? Why don't I ever see large, modern farm equipment in the fields? Oh, my international bond mutual funds work differently ...

You probably can't answer how my host family managed to get those lovely apple trees on one of their three, widely spaced allotments. 😉 But the question of why all those families who laboriously grow tomatoes in their market gardens can't get together and 1) combine transportation and sales; and 2) resurrect the old tomato sauce factory—might be in your wheelhouse. M

Thank you, David, for your insightful thoughts on a possible Moldovan bond market. The greatest challenge I have had over the years in trying to scare up FDI [Foreign Direct Investment] into Moldova is a lack of clear law, or at least the policing of any such law, and thereby clear and realistic exits of any investments. I agree that finance for business expansion is a huge challenge. Investors are very wary of what could happen to their cash inside Moldova.

Keep up the good work! Jim.